Building Financial Security for Your Future

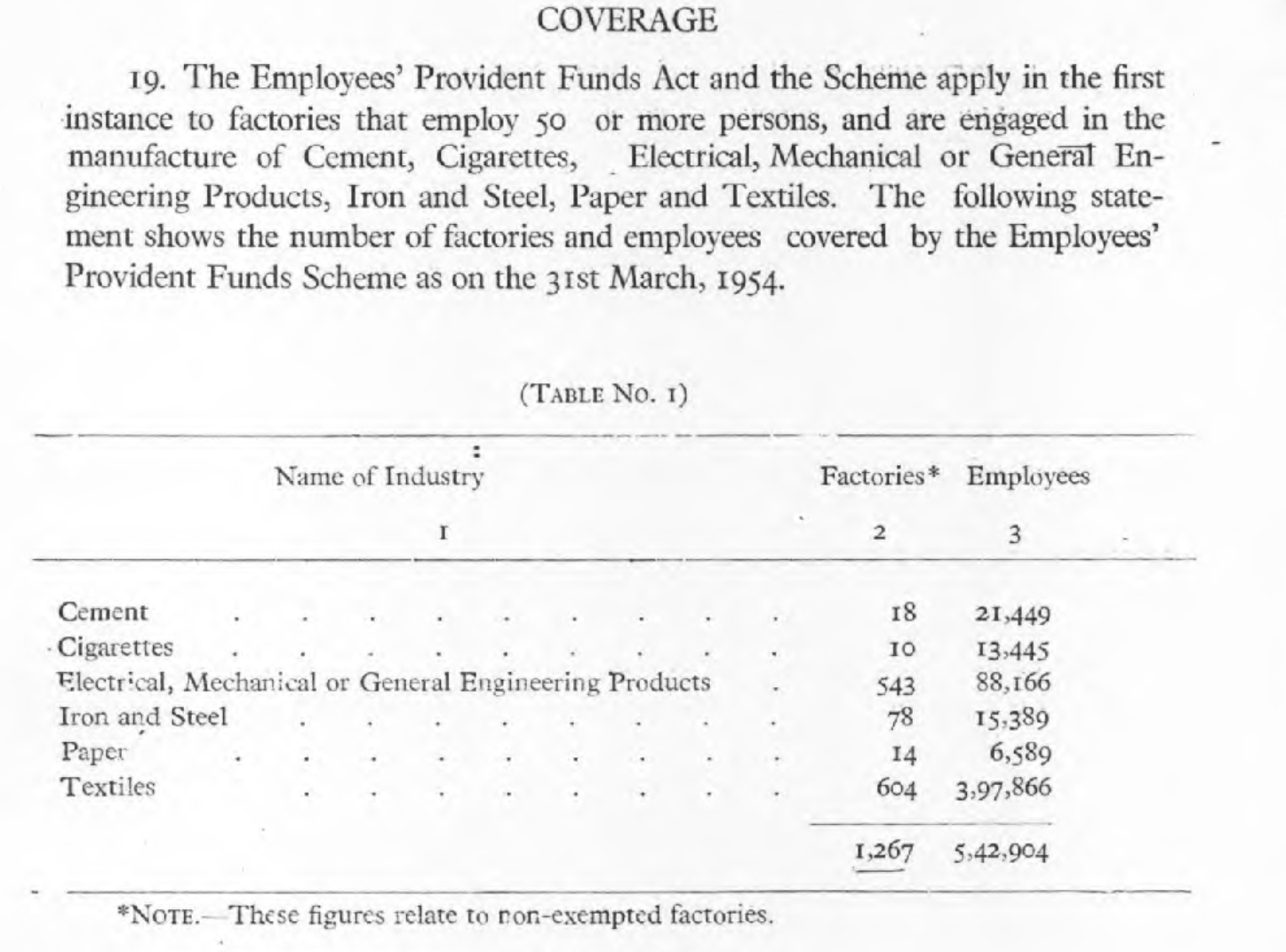

The Employees' Provident Funds Scheme, 1952, is a social security initiative in India that is administered by the Employees' Provident Fund Organisation (EPFO) under the Ministry of Labour and Employment, Government of India. The scheme is part of a larger legislative framework known as the Employees' Provident Funds and Miscellaneous Provisions Act, 1952.